Introduction -- Florida Workers' Comp Audit Checklist

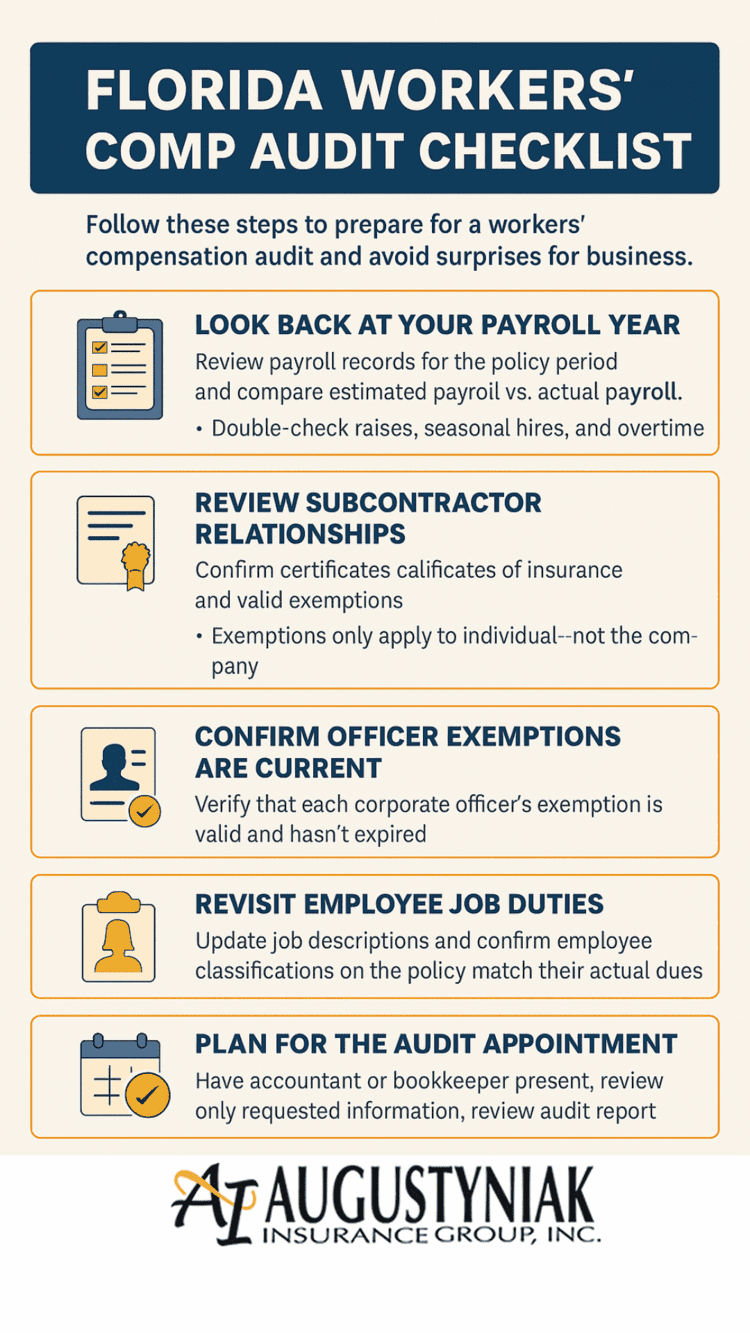

Getting notice of a Florida workers’ comp audit can feel stressful—but it doesn’t have to be. If you understand what the auditor is looking for, you can prepare ahead of time and avoid unexpected costs.

This step-by-step Florida workers' compensation audit checklist is designed to help business owners prepare for an audit. By following these simple steps, you’ll save time, reduce stress, and ensure your premiums remain accurate and compliant.

👉 For background on coverage itself, see our Florida workers’ comp insurance guide.

Step 1: Look Back at Your Payroll Year

Think of the audit as a “true-up.” The insurance company wants to compare your estimated payroll to your actual payroll for the policy year It's important that you review payroll records for the exact dates as your policy period — not just the calendar year. For example, many businesses run payroll from January to January, but their workers’ comp policy may cover different dates.

👉 Example:

- Estimated payroll: $100,000

- Actual payroll: $120,000 → You’ll likely owe additional premiums.

- Actual payroll: $80,000 → You may get a refund.

💡 Pro Tip: Double-check raises, seasonal hires, and overtime — these are common areas where businesses get surprised during an audit.

📂 Documents to Gather:

- IRS 941 quarterly payroll reports

- Payroll records or summaries from QuickBooks, Gusto, ADP, or other payroll software

- W-2 and 1099 forms for the policy year

- Overtime and bonus records

Having these ready makes your audit smoother and reduces the risk of errors or delays. Your bookkeeper or accountant is a great resource.

Step 2: Review Subcontractor Relationships

One of the biggest surprises in audits comes from subcontractors.

👉 Scenario: You hire a roofer as a subcontractor, but they didn’t carry their own workers’ comp coverage. The auditor could add their pay to your payroll, and you’ll be charged premium on it.

That’s why keeping subcontractor certificates of insurance or valid exemptions is critical.

📂 Documents to Gather:

- A list of all subcontractors paid during the policy year (from QuickBooks, payroll service, or accounting software).

- Certificates of Insurance showing valid workers’ comp coverage for each subcontractor.

- If a subcontractor claimed an exemption: their individual exemption certificate from the State of Florida.

⚠️ Important: Exemptions only apply to the individual named—not to an entire company.

Step 3: Confirm Officer Exemptions Are Current

In Florida, officer exemptions expire every two years. If an exemption expired mid-policy, the officer’s wages could be added to payroll—even if you assumed they were exempt the whole time.

👉 Quick Check: Use the Florida exemption database to make sure exemptions are valid before your audit.

📂 Documents to Gather:

- A copy of each officer’s exemption certificate showing it was valid during the entire policy period.

- Renewal confirmations if the exemption was renewed mid-year.

- Corporate officer list (from Sunbiz or your corporate filings) to match which officers are exempt.

⚠️ Important: If an exemption lapsed, even for a few weeks, the auditor may add that officer’s payroll back into your records for premium purposes.

Step 4: Revisit Employee Job Duties

Auditors compare what your employees actually did with how they were classified on the policy.

👉 Example: If you classified someone as “clerical” but they were out on job sites, that’s a higher-risk category, which means higher premium.

This is where updated job descriptions help protect you.

How NCCI and Class Codes Affect Your Audit

In Florida, job classifications are managed by the National Council on Compensation Insurance (NCCI). Each type of work is assigned a class code that helps determine your rate. If an employee’s duties change during the year, the auditor may adjust the class code accordingly.

- Clerical roles are typically assigned low-risk class codes.

- Field roles (e.g., roofing, electrical, landscaping) carry higher-risk class codes.

- Misclassification is a common source of surprise premium changes.

⚠️ Important: NCCI has detailed rules for each class code and job. Work with your insurance agent before renewal to make sure everyone is classified correctly. Sometimes even the location where an employee works changes their classification.

👉 Example: A telephone salesperson working in a separate office may qualify for a lower-risk clerical code. But if that same person sits on the production floor instead of an office, NCCI rules classify them the same as shop workers.

📂 Documents to Gather:

- Job descriptions for all employees.

- Timesheets or schedules showing primary duties and locations.

- Org chart or departmental list showing who does what.

- Any written role changes made during the year.

Step 5: Plan for the Audit Appointment

Whether your audit is conducted by phone, online, or in person, a little preparation can save you headaches.

📂 Documents & Preparation Tips:

- Bookkeeper or Accountant Available – Have your payroll professional on standby. They know where the reports are and can answer detailed questions quickly.

- Provide Only What’s Requested – Don’t overwhelm the auditor with extra information. Extra details can confuse the process or even create new questions.

- Review Before You Sign – Always review audit documents before signing. Look for errors in payroll totals, classifications, or subcontractor entries.

- Keep Copies – Save a digital copy of everything you send to the auditor for your own records.

- Ask Questions – If something doesn’t look right, speak up. Auditors can make mistakes too.

👉 Pro Tip: Assign one person (owner, office manager, or accountant) to be the main contact for the audit. This prevents miscommunication and ensures the auditor gets consistent answers.

Final Thoughts

The key to preparing for your Florida workers’ comp audit is to think like the auditor: payroll, subcontractors, exemptions, and job duties. If you cover those bases, you’ll avoid surprises and keep your premiums accurate.

If you are looking for a new agent or want help exploring your workers' compensation options, we would love to assist you. Augustyniak Insurance has over 2,000 Google reviews, and writes business and workers' compensation policies across the state of Florida and Georgia.

Related Articles

- Florida Workers’ Comp Insurance: Core Guide

What coverage includes, who needs it in Florida, and how rates work.

- Florida Contractors: Guide to Workers’ Compensation for Contractors

Requirements for contractors/subs, common pitfalls, and compliance tips.

- How to Verify a Florida Subcontractor’s Workers’ Comp or Exemption

Step-by-step verification so you’re not charged for uninsured subs at audit.

FAQs

What documents should I gather before a workers’ comp audit?

Payroll summaries, W-2s/1099s, overtime and bonuses, job descriptions, and subcontractor certificates or exemptions for the full policy period.

How do NCCI class codes affect my premium?

NCCI class codes assign a risk level to each job type. If actual duties differ from what’s on your policy, the auditor may reclassify, which can raise or lower the premium.

What if a subcontractor didn’t have coverage?

If a sub lacked workers’ comp or a valid exemption, payments to that sub may be added to your payroll for rating purposes.

Can I get an extension if I’m not ready?

Often yes, but you must request it from your carrier before the deadline. Don’t ignore audit notices—penalties can include cancellation or maximum payroll charges.

How long does a workers’ comp audit take?

Telephone or online audits can take under an hour if records are organized. In-person audits vary by size and complexity.